The traders in the UK are faced with several options when it comes to choosing the best trading platform. A trader must take into consideration a variety of factors when choosing a platform. They should consider the price features, features, and the reliability of technical support. Since it allows users to integrate features from their brokerage account directly into their trading programs using the UK trading API is a good choice. It is used by most UK retail brokers. It lets clients look for new openings, and place orders with live price updates. trading platforms uk have the option of selecting from a range of API software online, or creating their own at the website of their broker.

These aren’t the only ones. UK trading APIs give traders access to precise market data. A good API will also provide historical data on a particular instrument. It is imperative to choose a UK trading platform that is able to give its users access to these tools. These sophisticated tools will enable traders to get the most benefit from their UK trading experience.

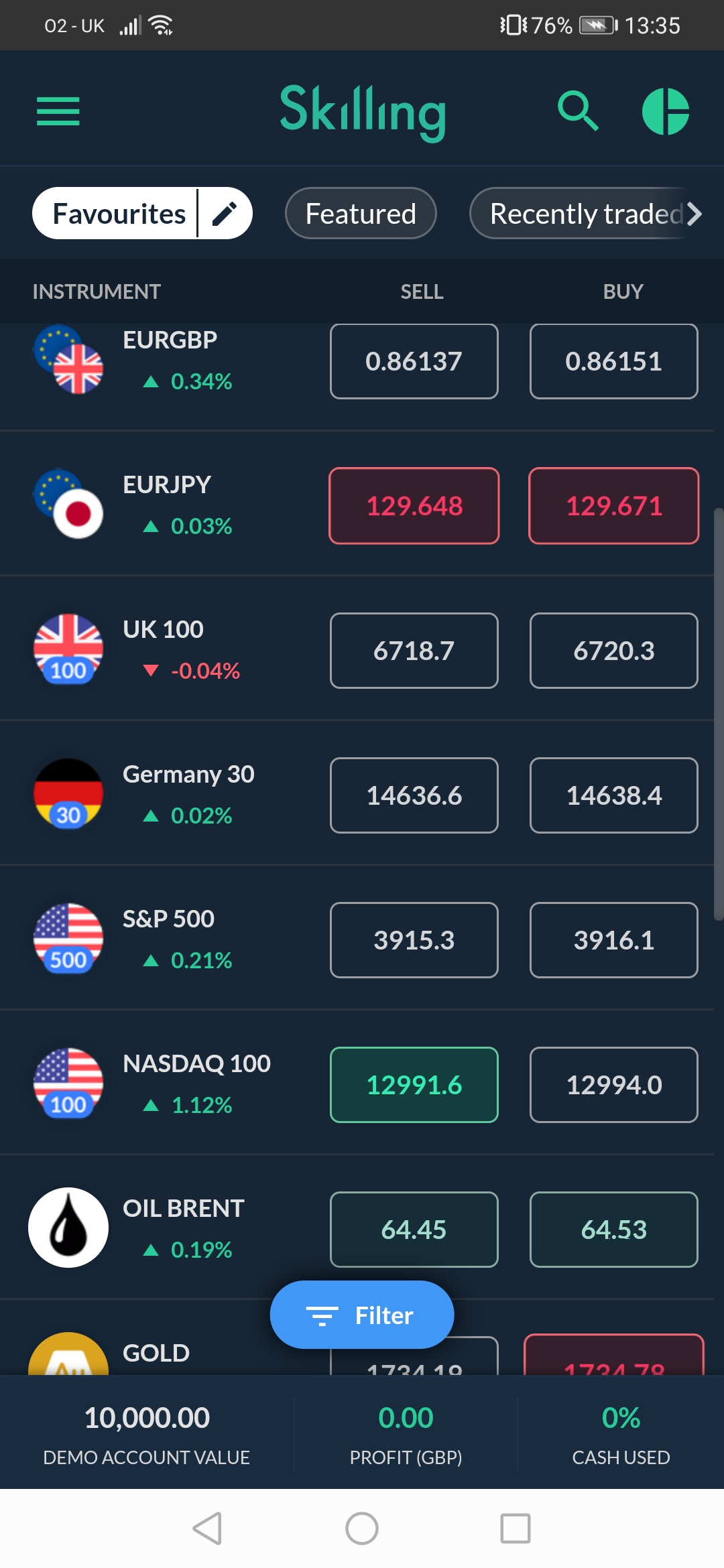

UK traders prefer to trade online with platforms that offer low spreads and fees. Some of the best platforms include AvaTrade. The broker offers a variety of CFD instruments with low commissions and with competitive spreads. It also has an incentive program for loyalty and an account demo for free. The platform is popular with high-frequency traders.

A great customer service is a crucial aspect of any trading platform. Customer service should be quick to respond to any inquiries or concerns. You could find yourself in financial trouble, or even worse when you don’t have access to customer service. A platform that provides prompt customer service will lower this risk for you and give you the peace of mind you need to continue your trading.

A commission is a different aspect to consider when choosing an online trading platform. Different platforms have different commissions but they’ll have lower costs for trades with less risk. A UK trading platform with low commission rates is a great option for novice as well as advanced investors. A platform that charges low commissions could be beneficial for those who don’t have enough knowledge of investing to make informed choices.

MT4 is the most popular Forex trading platform in Britain. It allows traders to trade simultaneously using multiple currencies. It is perfect for British traders because of its flexibility and adaptability. It also allows for customisation of the trading account through the use of the API. The platform also offers an online marketplace that lets traders download indicators and quotes to make their trading experience more personal. It’s also no cost, making it a great option for beginners in the UK.

eToro is a renowned worldwide broker with over ten million members. Its trading platform is easy to use and customizable. It works with all types of devices including smartphones, tablets and desktops.